Pre-1933 Gold

Austin Rare Coins specializes in Pre-1933 United States Gold Coins. Truly rare coins are featured individually by date in our Rare Gold Coin inventory. This page is dedicated to coins offered by grade instead of date. More specifically, high-end, investment-grade coins certified by PCGS or NGC along with their low-cost, uncertified, lightly circulated counterparts. Learn more by reading below.

What is a Vintage U.S. Gold Coin

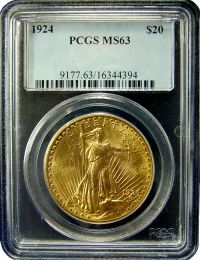

Due to the federal government recall order by President Franklin D. Roosevelt on January 30, 1934, all gold coins were confiscated from American citizens. Those that managed to survive are vintage U.S. coins fixed in an extremely limited supply and well sought after by coin collectors and investors around the globe. These vintage U.S. gold coins include the popular $20 Saint-Gaudens Gold Double Eagle Coin beautifully depicting Lady Liberty holding an olive branch in one hand and a torch in the other on the obverse and an eagle in flight, backed by rays from the sun on the reverse. Another vintage U.S. gold coin is the Indian Head series designed with a Native American in full headdress on the obverse side and a bald eagle perched on wood on the reverse. Your Pre-1933 gold coin collection wouldn’t be complete without a $20 Liberty Gold Double Eagle. These American gold coins were loved for their attractive design featuring Lady Liberty surrounded by 13 stars on the obverse and a bald eagle with wings extended on the reverse. While these are some of the most common US gold issues, there are other, older designs to collect as well. The first US gold issues date back to 1795 and are some of the most impressive and iconic designs ever seen on any world gold coins. Please call or email a Rare Coin Advisor at Austin Rare Coins & Bullion. We are knowledgeable and happy to help with your goals and objectives. When it comes to rare coins, our name speaks for itself! At Austin Rare Coins, we pride ourselves on offering the best deals on a wide selection of great options that have been certified by PCGS and NGC.IDEAL FOR DIVERSIFICATION

Smart gold buyers understand the wisdom in adding to their modern bullion coins by diversifying into other market segments that offer additional profit potential like older US Gold Coins.

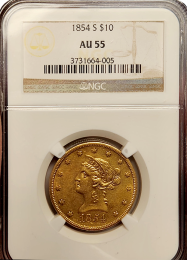

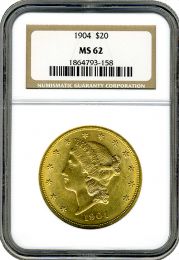

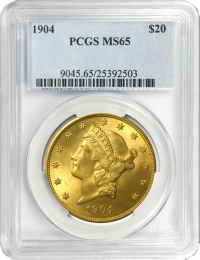

In 1933, President Roosevelt ceased the production of US Gold Coins and confiscated that which was already in circulation. When gold ownership was finally legalized again in 1974, the Pre-1933 US Gold Coin Market was created. “Investment-Grade” Gold refers to coins from this era that are more available than their truly rare counterparts and, therefore, can be acquired in high-uncirculated quality (MS-62 to MS-66 grades, explained below) at affordable prices. Investment-grade coins must be certified by either PCGS or NGC, the only two trusted grading companies in the business.

“Raw” or “uncertified” gold refers to Pre-`33 coins in lower-uncirculated and circulated quality that don’t necessitate PCGS/NGC grading and offer lower price points closer to their bullion counterparts. We’ve specialized in Pre-1933 US Gold Coins for over 30 years, so we can help you with the learning curve. Whether you need a full education or just have a couple of questions, please call us at 1-800-928-6468.

PRE-1933 U.S. GOLD SERIES: THE MODEL FOR MODERN GOLD AMERICAN EAGLES For decades up until the 1933 confiscation, gold coins served as American currency. Although other denominations and design styles were made, we’ll focus on the four core denominations and two core styles. While the face values are different, the gold weight of Pre-1933 Gold Coins is similar to those of modern Gold American Eagles: >$20 gold coins: weigh about 1-oz. and are often called “Double-Eagles” >$10 gold coins: weigh about a 1/2-oz. and are often called “Eagles” >$5 gold coins: weigh about a 1/4-oz. and are often called “Half-Eagles” >$2.5 gold coins: weigh about a 1/10-oz. and are often called “Quarter-Eagles” LADY LIBERTY DESIGNS UNTIL 1907 For the second half of the 1800's into the early 1900's, all four gold denominations were struck with designs highlighting one of the most classic and enduing American symbols, Lady Liberty. Known as “Liberty Gold Coins”, “Liberties”, or “Liberty Heads”, each coin’s obverse (front of the coin) features Lady Liberty’s head in profile wearing a coronet bearing an inscription of her name surrounded by 13 stars for the 13 original colonies. The reverse design is equally patriotic with a close resemblance to The Great Seal of the United States featuring a shield guarding an eagle with wings spread holding arrows in one talon and an olive branch in the other. A surrounding banner features the national motto “E Pluribus Unum”. Stars and rays sit above the eagle with “United States of America” along the top rim and the coin’s denomination along the bottom. 1907 DESIGN OVERHAUL INTRODUCES THE $20 ST. GAUDENS After nearly six decades of use, by 1907 it was time for a complete redesign of America’s gold coins; a change strongly favored by President Theodore Roosevelt. While the face values and gold weights remained consistent, all four coins underwent a major overhaul and various designs were introduced across the four core denominations for the first time. Named after its designer, Augustus St. Gaudens, the cornerstone $20 Liberty was replaced with the $20 St. Gaudens featuring a striking rendition of Lady Liberty walking “off of the coin” toward the holder complimented by a beautiful flying eagle on the reverse. This stunning patriotic design was immediately popular and became one of the most famous coins in U.S. history. The $20 St. Gaudens’ legacy became so strong that it would serve as inspiration for the US Mint’s Gold Eagle program fifty years after the last “Saint” was struck. $2.5, $5 & $10 INDIANS ACCOMPANY THE $20 SAINT Not to be outdone, designers were equally ambitious with the other three denominations. For the first time ever in U.S. gold coinage, the $2.5 and $5 designs featured a Native American in a full headdress. The $2.5 and $5 Indians also marked another premier feature – the features are struck into the coin or sunk below the coin’s surface – in what’s become known as “incuse designs”. Along with an updated American Eagle design on the reverse, these beautiful new elements combined to create a series of coins still famous and popular today. Bringing the post-1907 gold series together, the $10 Indian successfully combined the patriotism of the $20 St. Gaudens with the $2.5 and $5 Indian’s celebration of Native Americans with a stunning portrait of Lady Liberty wearing a Native American headdress plus the reverse eagle design of its smaller counterparts. 1933 CONFISCATION CREATES “PRE-1933 U.S. GOLD COIN MARKET” The gold coin supply during this time period was naturally diminishing due to the normal process of coins being heavily used as money and taken out of circulation to be melted and made into new coins. However, a major historical event ended production and further limited the supply of U.S. gold coins. In 1933, amidst The Great Depression, gold coin production was ceased, gold ownership was mostly outlawed, and the Government confiscated the gold coins in circulation. Some of this supply was exported to Europe to make debt payments while a lot of the coins were melted into bars. It would be over 40 years before Americans could legally own gold again and The U.S. Mint would finally return to making gold coins. The Liberty, St. Gaudens, and Indian Gold Coins became the “Pre-1933 U.S. Gold Market” – a segment of the broader gold market of historical coins with inherent value greater than their gold weight due to their vintage nature plus their fixed and limited supply – attractive features that modern made gold bullion coins simply can’t offer. Pre-1933 coins of higher quality have higher value. So how can dealers, investors, and collectors find a level playing field where all parties can trust a coin’s authenticity, agree on the quality, and create a highly liquid market not limited by the need to see every coin in person? PCGS & NGC: INDEPENDENT AUTHENTICATION, GRADING & CERTIFICATION To overcome these obstacles, two independent companies, PCGS (the Professional Coin Grading Service) and NGC (the Numismatic Grading Corporation), have been trusted to authenticate and grade coins – judge their quality – for over 30 years. To prevent any conflict of interest, these two companies don’t sell coins, they only handle authentication and grading services. Every coin submitted to PCGS and NGC is studied by a group of numismatist or rare coin experts. Their first step is to verify that each coin is authentic. Second, they look for any damage, modifications, or improper cleaning. Finally, they judge the coin’s quality using a numerical 1-70 grading scale in which 70 is the highest grade, a perfect coin. A grade of 60 and higher indicates uncirculated quality which is also called “Mint State”, abbreviated as “MS”, thus grades are seen in the format of “MS-63”. On that note, MS-63 to MS-66 indicates what we call “Investment-Grade”. Our site is designed to offer research on all segments of gold, silver, and other precious metals, but our Gold & Silver Advisors are also available to educate and answer your questions directly. Please call us for help at 1-800-928-6468. CERTIFICATES & SEALED HOLDERS ENSURE GRADING & LIQUIDITY Upon completing the grading process, each coin is sonically sealed inside a rectangular, hard plastic case often called a “slab” or simply a “holder”. Along with the coin, the slab also holds the grading certificate which displays the coin’s “biographical information” including the date, mintmark, denomination, and grade plus a serial number registering the coin with the grading company along with that company’s insignia. The sealed plastic holders can only be opened with brute force which is immediately obvious in a damaged holder. This safeguard prevents any tampering with either the coin or grading certificate creating peace of mind for buyers and easy liquidity even across great distances. NOT ALL OLDER COINS ARE RARE, EXPENSIVE, AND JUST FOR COLLECTORS Don’t assume all vintage/historical/Pre-1933 Coins are “rare and expensive coins for collectors and wealthy investors”. Rare Coins are in separate section on this site for a reason. This section is dedicated to coins from the same era that are more available and trade for more affordable prices than their truly rare counterparts. There are certainly Liberty gold coins from the 1850’s and 1860’s that are very rare and demand prices of $10,000 on up to six figures. Same for the $20 St. Gaudens and Indians. However, each of the eight Pre-1933 Gold Coins also offer various dates that survived the confiscation plus decades in bank vaults in greater quantities than their rare-date counterparts. To simplify the contrast, these can be called “common-dates”. This greater supply creates the opportunity to own high-quality, uncirculated, vintage U.S. Gold Coins at far more reasonable prices, generally ranging from around $500 to around $2,500. Specifically, Investment-Grade Pre-1933 US Gold Coins have been graded and certified as Mint-State-63 to Mint-State-66 quality (though we do include some MS-62 grades in this section for convenience). With rare-dates, a coin’s year of mintage and number of survivors are critical criteria. In contrast, with their common-date counterparts, those criteria are far less significant with the primary focus on the type of coin ($5 Liberty, $10 Indian, etc.) and the quality of the coin (MS-63, MS-64, etc.). INVESTMENT-GRADE PRE-1933 GOLD COINS: THE BULLION-BUYER’S “RARE COINS” Most gold buyers get started with modern gold bullion like 1-oz gold bars, Gold American Eagles, or Canadian Maple Leaf gold coins which is smart, everyone should have a foundation in bullion. While rare coins appeal to many as they begin diversifying into gold, many others don’t see the appeal or simply haven’t considered it. However, as those gold buyers gain experience, they learn that there’s an ideal option which offers the advantages of the Pre-1933 U.S. Gold Market without the need to become what they see as a “coin collector” buying “high priced rare coins”. That option is Investment-Grade Pre-1933 Gold Coins, “rare coins” for the bullion-buyer. This is truly a segment of the gold market that provides a simplified avenue for diversifying into the benefits offered by age and rarity discussed below at a price range reasonable for all gold bullion buyers which is why they’re often called “semi-numismatics” (numismatics is a fancy word for rare coins). PRE-1933 U.S. GOLD ADVANTAGE #1: BALANCE & DIVERSITY The longstanding, common-sense advice of balance and diversity apply just as much to precious metals as any other market. Just as it’s wise to diversify beyond just one stock, it’s equally wise to diversify beyond just gold bullion. Again, gold bullion is your foundation. It’s key to build on that foundation and add balance in the form of other precious metals like silver, platinum, and palladium, but also by diversifying into other segments of the gold market that offer advantages missing in gold bullion. PRE-1933 U.S. GOLD ADVANTAGE #2: GREATER SAFETY We’ve long been proponents of acquiring physical gold as a means to take some money “out of the system” to both increase your “private wealth” and protect a portion of your digital assets in a form of real and tangible money for safety in case of possible temporary disruptions to the dollar or banking system. Pre-1933 U.S. Gold Coins expand on this popular gold objective in offering greater safety from potential government action. Previously, we mentioned the government confiscation of 1933. It’s easy to take for granted such action couldn’t occur again. However, you can consider any form of government action against gold low-probability and still see the logic in taking reasonable precautions against such a disruptive event. It’s impossible to know exactly how new government controls or a full-on confiscation would unfold, it’s highly likely that “Target #1” would be any and all gold bullion – all modern made coins and bars with value based solely on their gold weight regardless of where they were made. It's also highly likely that safety would be found in Pre-1933 U.S. Gold, particularly coins in Investment-Grade quality (as well as their rare-date counterparts) due to their greater age, greater rarity, and greater value. Confiscation requires compensation so if the government is required to pay for the gold they’re taking, the more coins are worth than their gold weight, the less likely they’ll be confiscated with most likely being completely exempt. PRE-1933 U.S. GOLD ADVANTAGE #3: PRIVACY On a related topic, Pre-1933 Gold Coins also offer more individual privacy than modern bullion. Many gold bullion products, like all gold bars and gold Canadian Maple Leaf coins, fail in this regard. While bullion purchases remain completely private, many liquidations must be reported via IRS form 1099-B. In contrast, all Pre-1933 U.S. Gold Coins are completely private and non-reportable, no 1099-B required. While profits aren’t tax-exempt, few capital gains are, this extra privacy allows you to maintain control of your personal information and finances as reporting responsibilities are solely yours. With the ubiquity of account creation, contracts, paperwork, automatic reporting, the sharing of social security numbers and other personal information, it’s a pleasant surprise to find assets with extra privacy and advantageous to take advantage. Want to learn more about Pre-1933 U.S. Gold Coins, but prefer to talk to a person? Our Gold & Silver Advisors offer a no-pressure focus on advice, education, and guidance on all things precious metals. Please call us for help at 1-800-928-6468. A FIXED & LIMITED SUPPLY – IN CONTRAST TO GOLD BULLION In addition to increased diversity, privacy, and safety, a key attraction of Investment-Grade Pre-1933 U.S. Gold Coins is superior profit-potential. A rising gold price obviously drives rising prices for all segments of the gold market. Bullion coins and bars will increase directly with the gold market, dollar-for-dollar. Therefore, a foundation in bullion, as we’ve mentioned, will prove smart and prosperous in a gold bull market. However, this direct correlation with the gold price is also a limitation. While it’s a slow process, the bullion market expands every year as new coins and bars are added to the supply and very little of the existing bullion supply going back decades is used up. This makes it very unlikely that any modern gold coins, and especially bars, will offer premium performance beyond that of the rising gold price. In contrast, prior to 1933, U.S. Gold Coins were used daily as regular money. As the coins wore out from use, they were removed from circulation and melted to make new coins making the supply naturally contracting. That supply was then fixed when production ended in 1933 and was further reduced by the subsequent melting of much of the confiscated coinage. PRE-1933 U.S. GOLD ADVANTAGE #4: PREMIUM PERFORMANCE Focusing on coins that have survived in high, Investment-Grade quality reduces that supply even further, tilting the laws of supply and demand in the favor of the smaller market. Rising gold prices creates rising demand. That demand moves into all segments of the gold market including the fixed and limited supply of Investment-Grade Pre-1933 U.S. Gold Coins. This creates their extra profit potential as they take advantage from both rising gold prices and demand overwhelming their limited supply. During past gold bull markets, the strategy of owning both bullion and Pre-1933 Gold Coins has proven extremely successful with strong phases of out-performance in Pre-1933 Coins. This profit advantage is another characteristic which attracts many bullion buyers to build on their foundation by diversifying into Investment-Grade Pre-1933 U.S. Gold Coins. PRE-1933 U.S. GOLD ADVANTAGE #5: OVERLOOKED & UNDERVALUED While gold bullion and Pre-1933 U.S. Gold Coins follow the same longer-term trends, as mentioned above, there are also phases when the two markets move independently. This is a key reason supporting diversity within a gold portfolio – it creates exposure to outperforming sectors of the market while others are temporarily lagging. Since the 2011 peak in the gold market, both gold bullion and Pre-1933 Gold Coins experienced the normal, cyclical correction that follows such peaks. However, in the process, the two markets entered one of these phases in which they’re moving independently. While the gold market (and thus modern gold bullion) have risen quietly, but consistently since touching its cyclical low under $1100, Pre-1933 Gold Coins trended behind the gold market and reached their corresponding cyclical low considerably later and are earlier in their recovery. This is like being able to go back in time and buy gold at lower prices during an earlier phase in this renewed bull market. Investment-Grade Pre-1933 U.S. Gold Coins are simply trading at a steep discount to gold bullion making them one of the most undervalued sectors in precious metals. This creates the advantages of lower risk, better value, and increased upside potential making it even clearer why Investment-Grade Pre-1933 U.S. Gold Coins are “the bullion buyer’s rare coins” and chosen market segment for diversification. UNCERTIFIED “RAW” PRE-1933 GOLD: BULLION WITH MUSCLE There’s one final semi-numismatic market segment that’s appealing to buyers attracted to the advantages of Pre-1933 Gold Coins, but prefer prices close to their modern bullion counterparts, i.e. old $20 Gold Coins priced close to 1-oz. Gold American Eagles. These are still Liberties, St. Gaudens, and Indians coins as discussed above, but in lower grades, often circulated quality. Given their lower quality and greater availability these coins trade for less than their Investment-Grade counterparts and closer to their gold weight. Therefore, PCGS/NGC grading is unnecessary leading to the term “Raw Gold Coins”, Pre-1933 U.S. Gold Coins that are not certified by the grading companies. This page is focused primarily on Investment-Grade Pre-1933 U.S. Gold Coins. Uncertified, raw Pre-1933 Gold is explored further on the following pages: Rest assured that we’re here to answer questions and offer no-pressure one-on-one guidance on Pre-1933 U.S. Gold Coins as well as the broader gold and silver markets. Please call us for help at 1-800-928-6468.